Almost twenty billion dollars in perpetual futures positions were liquidated during the Oct. 10 crypto crash, prompting traders to ask who should pay if platforms fail under pressure.

Unlike regulated securities exchanges, crypto venues can pull liquidity, cut profitable positions and often rely on arbitration clauses that limit legal recourse — as long as users have clicked “I agree.”

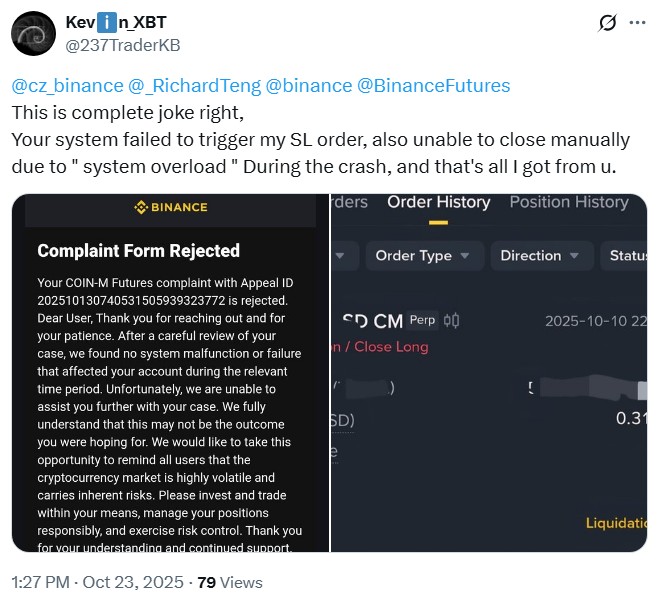

In the latest liquidation frenzy, Binance was at the center of controversy as some users claimed they were unable to properly close their positions in time. Binance said its core features remained operational, but acknowledged technical glitches that caused certain asset prices to appear temporarily depegged from the broader market.

Earlier this weeks social media was rife with rumors that market maker Wintermute planned to sue Binance over losses sustained during the crash, although that was quickly denied by CEO Evgeny Gaevoy.

To better understand how crypto exchanges are expected to perform during extreme market conditions — and what legal protections traders have — Magazine spoke with attorney Yuriy Brisov of Digital & Analogue Partners.

This conversation has been edited for clarity and length.

Magazine: From a legal standpoint, how are crypto exchanges classified and regulated compared to traditional securities exchanges?

Brisov: In the past, the Securities and Exchange Commission has said that certain crypto-asset trading platforms perform functions similar to regulated securities exchanges but have not registered or complied with the regulatory requirements applicable to traditional exchanges.

Now, everything is changing. That opens a lot of opportunities for crypto companies to offer risky products like memecoins, futures and other derivatives. We do not even know whether these products fall under the jurisdiction of the SEC or the Commodity Futures Trading Commission. They recently cleared certain turf disputes between them, but there are still vague areas about who is in charge of what.

Before this, we assumed the SEC was responsible for everything. Now, if it is derivative trading, it is probably under the CFTC because it is treated more like commodity trading.

In the US, when a crypto trading platform is not registered as a securities exchange, broker-dealer or alternative trading system, the law treats it simply as a private marketplace matching buyers and sellers. Market makers on these platforms generally have no legal obligations to provide liquidity and can enter or exit the market freely.

Magazine: What legal responsibilities do exchanges have when leveraged positions cascade into losses during a market crash?

During the recent crash, leveraged traders incurred losses that exceeded their posted collateral. In a traditional securities market, there are mechanisms that prevent losses from exceeding collateral, but in this case, market makers withdrew liquidity, and the platform did not absorb the shortfall. Binance, for example, references an insurance or guarantee fund in its documentation, but the size of this fund and the precise mechanics of its use during extreme volatility are not fully transparent.

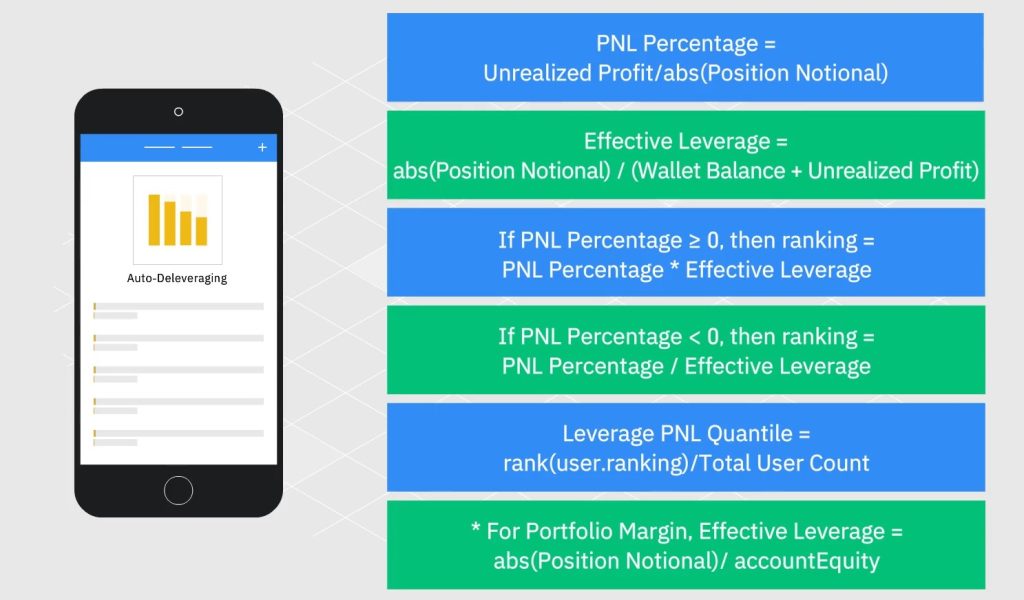

In the recent crash, exchanges later stated that its auto-deleveraging (ADL) system was triggered, meaning that profitable positions were automatically reduced to offset the losses of liquidated traders, effectively reallocating gains from winning traders to cover the deficits of losing ones.

Was it legal? If we read their terms, yes. If we look at crypto markets as they are now, it’s purely contractual relations.

Magazine: What exchange obligations are mandated on traditional platforms like Nasdaq?

Brisov: There are legal mechanisms that require exchanges to continue trading during their trading sessions. They also have to be liable for any technical glitches. If I am technically unable to access my Nasdaq account, I can sue Nasdaq and be compensated according to a fair market estimation of my loss.

Market makers and dealers on Nasdaq and other regulated exchanges are licensed, and there are evaluations of how much leverage can be allowed for different types of trading. There are insurance funds, and insurance companies must cover losses. There are no ADL mechanisms on these exchanges, and they have to compensate for these losses if they do not provide safe mechanisms for trading.

Magazine: Do crypto exchanges adequately disclose the legal and financial risks of trading on their platforms, especially during extreme volatility?

Brisov: There is no specific law that regulates an exchange like Binance. It’s a website and a marketplace. They have this disclaimer that you are dealing with crypto at your own risk. But do investors understand that one day all my profits can just disappear? Liquidated? I’m not sure that many crypto traders do.

Binance now offers to cover losses, but only if you can prove that it was a technical issue. They are not saying that they will compensate for any loss due to a market crash, because the traders bear the market risks.

It’s the same as on traditional exchanges. But technical risks are the responsibility of the platform. It was even the case with Robinhood in 2020. When there was an outage in the technical trading operation system, a class-action lawsuit was filed against them. It was settled, of course. If it’s a technical error, the platform must be responsible.

Magazine: How enforceable are Binance’s terms of service in different jurisdictions, and what legal recourse do users have despite arbitration clauses?

Brisov: When you become a client of a platform, you should follow its terms. In Binance’s terms, there is a Hong Kong arbitration clause that says you cannot sue them in your jurisdiction. You must go to Hong Kong for arbitration, which is costly. You have to hire an arbitrator with your own money. And there is no way to file a class action through arbitration because it’s private and secret. Their terms are very favorable toward Binance.

However, there are also consumer protection laws that ask: Was it really clear? Were there enough disclaimers? Was the language of this contract understandable for a normal user?

Binance is not only for sophisticated investors. It’s a platform for everyone. So I think if someone files a lawsuit in their jurisdiction, even if they attempt to file a class action, there is still a chance that it may succeed, even despite the arbitration clause and strict terms.

Yohan Yun

Bitcoin mining difficulty skyrockets, new Satoshi emails revealed, and more: Hodler’s Digest, Feb. 18-24

Bitcoin mining difficulty crosses 80 trillion ahead of halving, new Satoshi emails unveil Bitcoin lore, and FTX to sell $1 billion in Anthropic shares.

Read moreDeFi faces stress test, DoJ fears run on Binance, Hong Kong’s crypto trading: Hodler’s Digest, July 30 – Aug. 5

Curve Finance’s dramatic exploit exposes DeFi, DoJ concerns of a run on Binance, and Hong Kong debuts retail crypto trading.

Read moreWhy AI sucks at freelance work and real-life tasks: AI Eye